Becoming a caregiver for aging parents often falls disproportionately on daughters. As mothers and fathers decline in health, daughters overwhelmingly take on caregiving duties. This difficult transition can be exponentially more stressful when finances enter the picture. The potential cost of nursing home care weighs heavy, but Maryland daughters have a lifeline in Medical Assistance Long-Term Care (Medicaid).

In Part I of this article, we explored the common dynamic where daughters become caregivers later in life as their parents’ health declines. The immense emotional and physical toll of the “daughter track” was discussed. While caring for aging parents is rewarding, it also requires immense time and energy. Understanding Medicaid can help ease the financial burden of costs like nursing home care.

Now in Part II, we explain how a Medicaid attorney can help guide daughters through the complex application process. After assessing their parents’ finances, attorneys assist with compiling all the necessary documentation. Having an expert advocate ensures daughters can access the maximum benefits available through Medicaid for their parents’ long-term care costs. With proper planning, attorneys help qualify parents for coverage while still preserving assets. This strategic approach prevents daughters from fully depleting their own resources in the midst of an already taxing caregiving role.

In summary, Part I focused on the familial aspects of daughters acting as caregivers. Part II highlights the vital role attorneys play in securing Medicaid coverage for aging parents. Their expertise offers daughters both financial and mental reprieve. With an attorney’s assistance, daughters can avoid losing their sanity while providing care for parents in a time of need.

The Financial Strain of Elder Care

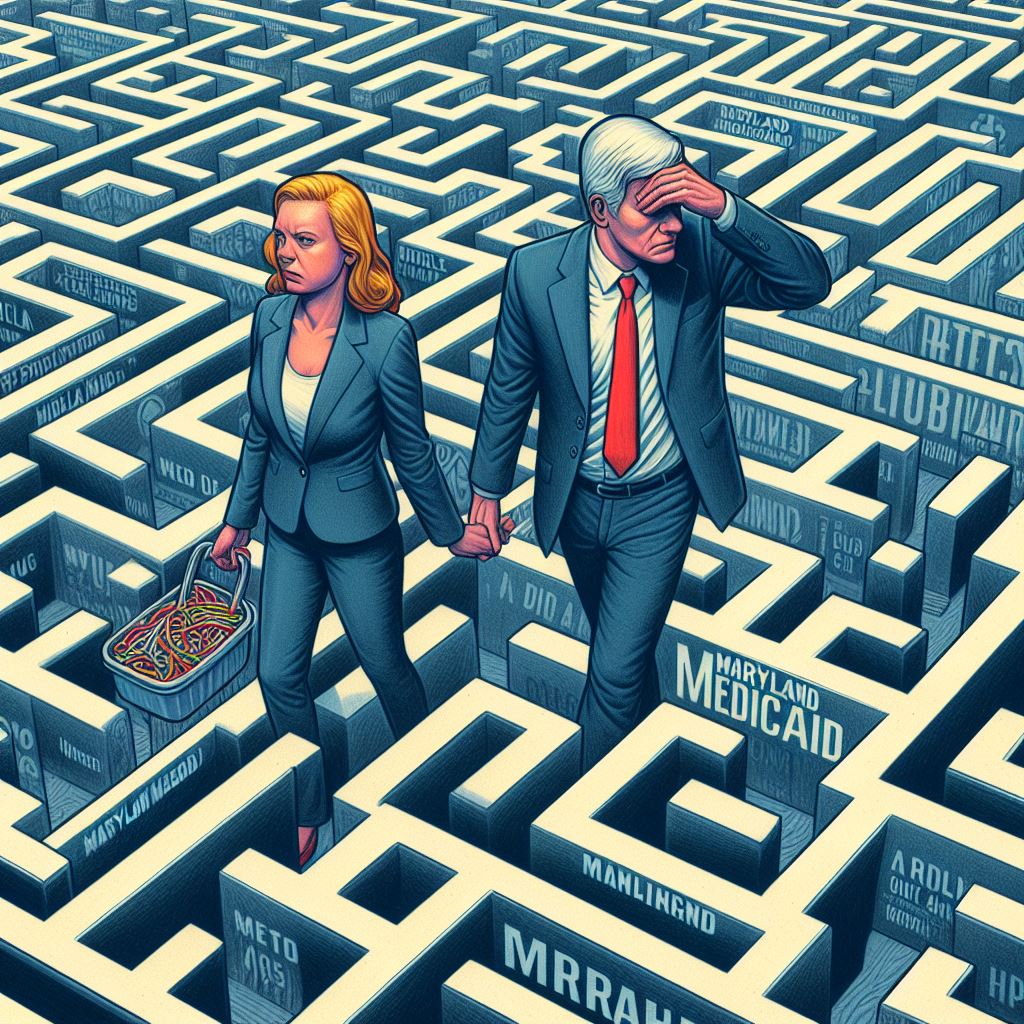

Navigating the financial terrain of elder care can often seem like a steep uphill climb. The caregiver, in most cases the daughter, typically faces the brunt of these expenses. The costs associated with medications, medical care, and more significantly, nursing home fees, can quickly pile up, transforming the caregiving journey into a financial marathon. The addition of this monetary stress to the already emotionally taxing role can make the responsibility of caregiving seem even more daunting.

Healthcare expenses for an aging parent can, at times, be unpredictable and overwhelming. What seemed manageable initially may spiral out of control, turning what should be a loving, nurturing relationship into a source of financial worry. It’s not just the large costs, like nursing home fees, that add up, but the smaller, continuous outflows too. Regular medications, medical appointments, assistive devices, home adaptations for accessibility, incontinence supplies, and a host of other requirements that surface along the way can take a toll on the caregiver’s finances.

In this scenario, the caregiver may find themselves juggling their own financial commitments, such as mortgage payments, education costs for their children, and their own retirement savings, alongside their parent’s escalating health expenses. It’s a challenging balancing act that can cause financial stress and anxiety, affecting the caregiver’s health and well-being.

Yet, amidst these challenges, it’s crucial to remember that financial strain should not overshadow the caregiving journey. While it’s a significant aspect of elder care, it should not become the sole focus or source of worry. While these costs may seem daunting, there are resources and support systems available to help shoulder the financial load of elder care. With the right information and assistance, caregivers can navigate this financial maze with more confidence and less stress, allowing them to concentrate more on the emotional aspects of caregiving, which are just as crucial, if not more so, in ensuring the well-being of their aging parent.

How Maryland Medicaid Can Help

Taking care of a loved one is no easy task, especially when it’s accompanied by a host of medical expenses. The weight of this financial burden often falls on the shoulders of the caregiver, adding to an already challenging situation. Enter Maryland Medicaid: a lifeline for those struggling with the financial aspects of elder care.

This state-provided assistance program is designed to alleviate the financial strain associated with aging health needs. It’s a catalyst that transforms the elder care journey from a looming financial mountain into a more manageable endeavor, offering a beacon of hope for caregivers grappling with rising healthcare costs.

Maryland Medicaid doesn’t just cover a portion of the expenses; it provides a comprehensive assistance program that covers a multitude of healthcare costs. From nursing home care to home health care services and even other medical necessities, Maryland Medicaid extends its support in myriad ways.

The program takes into account the escalating costs of nursing home care, which can often be the heaviest financial burden. By offering substantial assistance for these expenses, Maryland Medicaid can make a world of difference to caregivers. The impact is profound: easing the financial stress and allowing caregivers to shift their focus from worrying about funds to providing quality care for their parents.

But the support doesn’t stop at nursing home expenses. Maryland Medicaid also steps in to alleviate the costs of home health care services. Whether it’s round-the-clock nursing care at home or regular visits from health professionals, the program provides significant financial backing. This allows aging parents to receive care in the comfort of their homes, surrounded by their loved ones.

Beyond the costs of care facilities and at-home care, there are numerous other medical expenses that Maryland Medicaid helps mitigate. From medications to medical equipment and assistive devices, the program recognizes the diverse health needs of aging individuals and strives to cover a broad spectrum of costs. This comprehensive approach to financial assistance can make a significant difference to caregivers, enabling them to provide the best possible care without the constant worry of financial ruin.

The beauty of Maryland Medicaid lies not just in the financial relief it provides, but also in the peace of mind it brings. By easing the financial load, caregivers can shift their focus back to what truly matters: the physical and emotional well-being of their aging parents. The relief from financial stress, thanks to Maryland Medicaid, can create a more positive caregiving environment, leading to a healthier, happier journey for both the caregiver and the parent.

Thus, Maryland Medicaid is more than just a financial aid program.

Working with an Attorney

As a daughter, the duty of handling your parents’ Medicaid application often falls on your shoulders. While deeply meaningful, the process can also feel overwhelming. However, taking it step-by-step with the help of an attorney makes completing the application manageable.

Your first step is gathering all the required documents. This includes financial records, medical history, and personal information that paints a comprehensive picture. Sorting through the paperwork puzzle to find the right pieces takes time and care. An attorney can guide you on what’s needed and how to present it accurately.

Next, you’ll need to thoroughly understand your parents’ finances, as income and assets are key for eligibility. An attorney can interpret how different factors may impact the application and discuss strategies to address potential issues proactively.

With your documents and knowledge gathered, you’ll complete the lengthy application forms. Avoid trying to fill them out electronically, as online forms can lose data. Printing and handwriting ensures accuracy. Lean on the attorney to translate convoluted questions into plain language.

Stay organized by keeping digital copies of financial statements easily accessible online. This prevents you from drowning in a sea of paper. An attorney can review your completed application to catch any last-minute errors before submission.

While managing this process solo can seem monumental, remember you don’t have to go it completely alone. An attorney’s expertise lightens the load enormously. Breaking down the complex process into achievable steps helps you confidently complete the Medicaid application as a dutiful daughter.

Best Practices for the Process

Embarking on the Medicaid application process is akin to setting off on a critical journey. The initial step is gathering the necessary gear – in this case, vital documents that provide a comprehensive picture of your parent’s financial situation and health status. You’ll be pulling together items like income proofs, details of assets, comprehensive medical records, and other associated information. These documents collectively form the backbone of your parent’s Medicaid application. Understanding the nuances of your parent’s income and assets is equally crucial as it plays a significant role in their eligibility for Medicaid.

The preparation stage can often feel like trying to solve a jigsaw puzzle. Identifying the right pieces and fitting them together in a manner that presents a clear and accurate representation of your parent’s situation can be a complex task. This is where the expertise of a Medicaid attorney proves to be invaluable. They can guide you through the document maze, helping you sort, organize, and accurately present all the necessary information. They can also provide insights into how your parent’s income and assets might influence their eligibility, allowing you to address potential hurdles proactively.

In essence, preparation is not just about collecting a stack of papers. It’s about creating a robust foundation for your parent’s Medicaid application. The stronger the foundation, the higher the likelihood of successfully securing the assistance your parent needs. It’s a critical part of the journey, and with the right guidance from a Medicaid attorney, you can navigate this phase with confidence and clarity. Navigating through long term care and estate planning with your parent can seem overwhelming, but it becomes more manageable when supported by experienced professionals like JDKatz attorneys Medicaid planning. They can help provide clarity and peace of mind, simplifying the Medicaid application process for you and your family.

The Maryland Medical Assistance form for long-term care (i.e. Medicaid) can be daunting with its length and complex requirements. The 20+ page application tries to capture all financial, medical, and personal details needed to determine eligibility, but the breadth makes it unwieldy for applicants. Instead of tackling the official form right away, first use our free intake form to simplify compiling the required information.

Our intake form streamlines the process into clear sections and plain language. It covers the same details as the state form but breaks down the questions into an easy-to-follow flow. We designed the form based on years of experience guiding clients through Medicaid applications. The sections prompt you to gather personal information, insurance details, income sources, assets, and medical documentation. Instructions explain what counts for each section and how to calculate amounts.

We highly recommend printing out our intake form and filling it in by hand as you collect information. Do not try to complete the form electronically in your internet browser or a PDF reader initially. The electronic forms often fail to save new data correctly as you fill them out over time. Any data loss or reversion to old inputs creates more work to re-enter and increases chances of clerical errors.

Once you’ve compiled all the data in our printed intake form, you can easily transfer the information to the official state application. As an added resource, our website provides a copy of the Maryland Department of Health’s application checklist. Review this to ensure you complete all required sections and gather necessary documents before submitting.

For collecting financial statements and other documentation, use online storage like Dropbox or Box.com to keep digital copies organized. This allows you to easily store and access five years of bank records, brokerage statements, medical invoices, and other required paperwork without printing everything. Clients often find that the mountain of paper documents makes the application overwhelming. Digital organization simplifies compiling a complete record over months without loss.

The Maryland Medical Assistance application for long-term care Medicaid is challenging, but our free intake form along with digital storage makes the process manageable. Simplify your work by avoiding a confusing state application or disorganized records. Our tools allow you to methodically gather information and create an accurate submission.

Once you’ve assembled the information on your own, you should still consider having the application and supporting data reviewed by an attorney to identify any potential red flags, or other impediments to coverage PRIOR to submitting the formal application to the state. Remember once that application is filed, the representations can’t be unfiled, and gaps, errors, or mistakes will require substantial explanation at best, and could result in a denial or deferral of coverage by the State of Maryland.

Shifting the Paradigm: Equal Caregiving Responsibilities

The traditional biases and gender norms in elder care are deeply embedded, creating a disparity that we must actively address. The idea of caregiving being a woman’s role needs to be challenged, moving us towards a future where caregiving responsibilities are shared equally amongst siblings, irrespective of their gender. This is about building a new societal narrative that embraces sons as caregivers, not just daughters, nurturing their involvement in the full spectrum of elder care duties.

It’s about encouraging men to step into roles that go beyond financial support, fostering their participation in personal care tasks that they might traditionally avoid. We need to start these conversations, encourage these transitions, and challenge these norms. The goal? To make elder care a shared responsibility, lessening the burden on daughters and creating a more balanced support system for our aging parents.

Additionally, it’s crucial that we raise awareness about the assistance programs and resources available to ease the financial stress of elder care for sons and daughters alike. These programs, like Maryland Medicaid, can significantly lighten the financial load, offering a lifeline for caregivers as they navigate the complexities of elder care costs. Armed with the right information, sons and daughters can collectively shoulder the financial responsibility, making the caregiving journey less daunting and more manageable.

By promoting equal caregiving, we create a more supportive environment for our aging parents. It’s about ensuring their needs are met, that they’re cared for with love and dignity, and that the responsibility of their care is a collective family effort. This shift in perspective is not just about redefining caregiving roles; it’s about changing the narrative, breaking down gender stereotypes, and sharing the responsibility of love and care.

So, let’s encourage sons to step up, let’s equip them with the tools they need, and let’s support them in their caregiving journey. Let’s work together to shift the paradigm, fostering a culture that sees caregiving not as a gendered responsibility, but a shared endeavor. In doing so, we can help build a more equitable, balanced, and supportive caregiving environment, creating a positive and fulfilling journey for both our aging parents and ourselves.

In the end, isn’t that what family is all about?

Resources:

JDKatz Intake Form for Medicaid Applications )

Maryland Medical Assistance Long-Term Care Checklist

By: Jeffrey D. Katz, Esq., Managing Partner, JDKatz, P.C.